All about Insurance - Missouri Farm Bureau

The following situations may need a person to have an SR-22: Loss of license due to excessive points (more than 8) Loss of license due to Motor Vehicle Accident Judgment Loss of license due to driving with a blood alcohol of. 08% or more, or if under age 21 driving with a blood alcohol of.

Safe, Automobile will only issue a Missouri SR-22 to Missouri locals. RELATED LINKS Play It Safe with Safe, Automobile Insurance coverage Have a concern for us at Safe, Car? Need to start This Piece Covers It Well ? Just wish to talk? Call us at 1-800-SAFEAUTO or email us at . For common concerns, please consult our frequently asked question page.

Office hours Monday, Friday, 7:00 a. m. 10:00 p. m. CT, Saturday, 7:00 a. m. 4:00 p. m. CT, and Sunday, 9:00 a. m. 3:00 p. m. CT; closed on local holidays Phone number Email form.

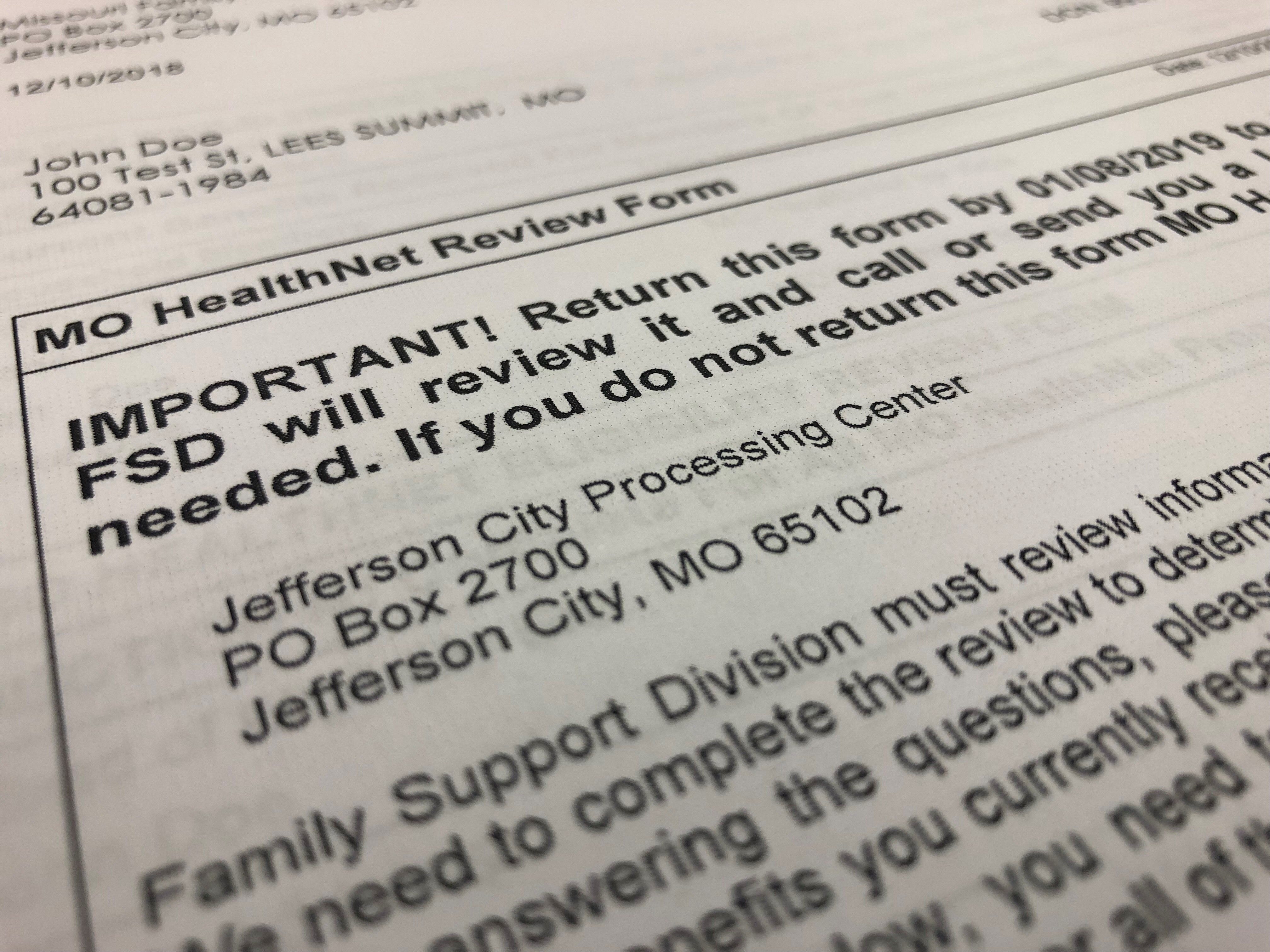

The Facts About Medical Insurance - Human Resources - Missouri State Uncovered

From unanticipated natural catastrophes to theft or vandalism, having property owners insurance coverage gives you assurance. And finding the very best coverage to safeguard your home begins with comprehending your alternatives. Have a look at some common coverages to get familiar with: Pays to restore or fix your home. Pays for damage to other, detached structures on your residential or commercial property such as garages, gazebos, sheds and fences.